April 15th… that dreaded date is rapidly approaching. As we scramble to pay “our fair share,” one question seems to get lost in the shuffle: What did I just pay for? Well, a lot of things. Some of which are going to surprise you. Perhaps you thought you were paying thousands for assistance to countries whose citizens seem to like to stomp around and burn our flag? No … it’s about $40 a year. Keep in mind now that if interest rates rise so will interest on the debt—and that could get nasty. Then again, if a major war breaks out, we’re all going to have to ante up.

April 15th… that dreaded date is rapidly approaching. As we scramble to pay “our fair share,” one question seems to get lost in the shuffle: What did I just pay for? Well, a lot of things. Some of which are going to surprise you. Perhaps you thought you were paying thousands for assistance to countries whose citizens seem to like to stomp around and burn our flag? No … it’s about $40 a year. Keep in mind now that if interest rates rise so will interest on the debt—and that could get nasty. Then again, if a major war breaks out, we’re all going to have to ante up.

The average household paid about $13,000 in income taxes to Uncle Sam for 2015. (We haven’t paid for 2016 yet remember.) Of that $13,000, the federal government spent:

$3,728.92 (28.7 percent) on health programs

$3,299.13 (25.4 percent) on the military

$1,776.06 (3.7 percent) on interest on the debt

$1,040.93 (8 percent) on unemployment compensation and labor programs

$771.26 (5 percent) on veterans’ benefits

$598.74 (4.6 percent) on food and agriculture programs

$461.59 (3.6 percent) on education programs

$377.50 (2.9 percent) on general government expenses

$250.03 (1.9 percent) on housing and community programs

$207.68 (1.6 percent) on energy and environmental programs

$194.29 (1.5 percent) on international affairs programs

$150.68 (1.2 percent) on transportation funding

$143.20 (1.1 percent) on scientific funding

Next question….Who’s actually paying most of the taxes? Do the wealthy pay less taxes than the middle class and the poor?

The study, from the Institute on Taxation and Economic Policy, found that “virtually every state’s tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from wealthy families.” The report added that state and local tax systems are “indirectly contributing to growing income inequality by taxing low- and middle-income households at significantly higher rates than wealthy taxpayers.” In other words, it said that the tax systems are “upside down,” with the poor paying more and the rich paying less. Overall, the poorest 20 percent of Americans paid an average of 10.9 percent of their income in state and local taxes and the middle 20 percent of Americans paid 9.4 percent. The top one percent, meanwhile, pay only 5.4 percent of their income to state and local taxes.

But numbers like these can be misleading, and there are two sides to every coin. Drawing a far different conclusion, the more conservative Tax Policy Center has concluded that the “top one percent of Americans paid 33.4 percent of their expanded cash income (a broad measure of pretax income) in federal taxes. Middle class Americans—or those in the middle 20 percent —pay 13.7 percent of their income to federal taxes, while the poorest pay 3.1 percent.

Up to now, it doesn’t appear that any study has looked at the combined federal, state, and local tax burdens as a share of certain income groups. But Roberton Williams of the Tax Policy Center said that combining all taxes would almost certainly show that the wealthy pay more than the rest.

In other words, we’re probably not going to be able to give you a final answer on that one any time soon. So I guess, as Einstein would have said, “Everything is relative”…even taxes.

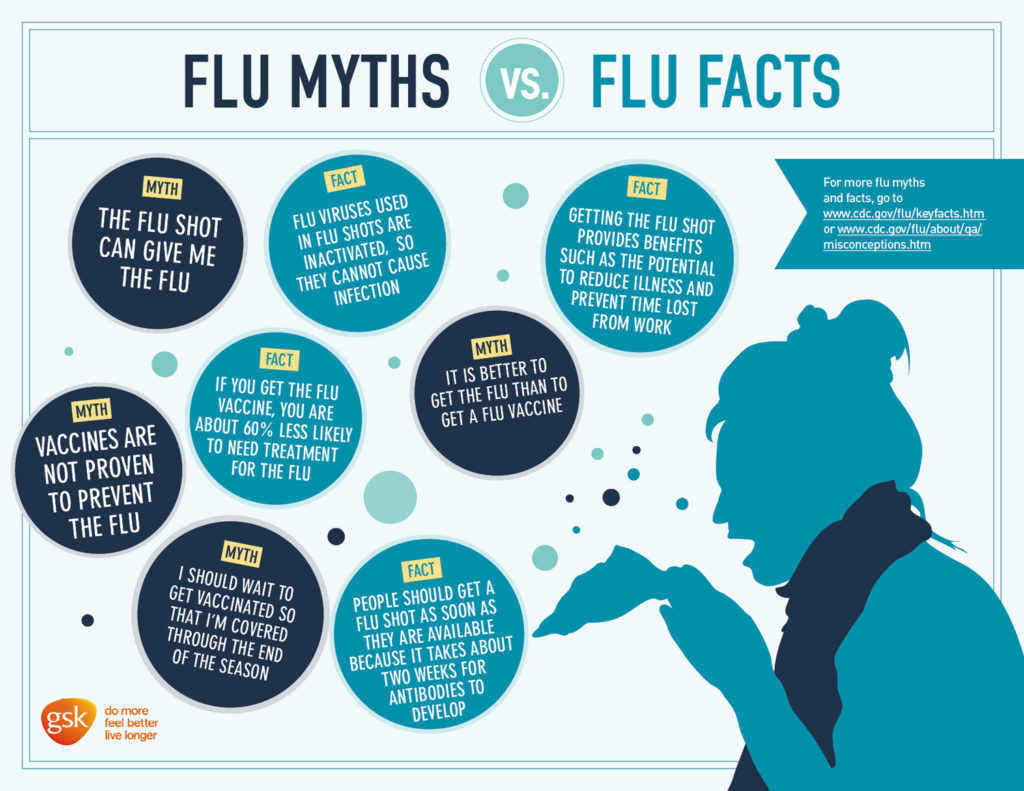

Flu season is here and health professionals recommend that you get a flu vaccine. The flu shot can reduce the risk of flu-associated hospitalization. The Centers for Disease Control and Prevention refers to a study published in 2016 that showed that people 50 years and older who got a flu vaccine reduced their risk of being hospitalized by 57 percent.

Flu season is here and health professionals recommend that you get a flu vaccine. The flu shot can reduce the risk of flu-associated hospitalization. The Centers for Disease Control and Prevention refers to a study published in 2016 that showed that people 50 years and older who got a flu vaccine reduced their risk of being hospitalized by 57 percent. The Stoneman Douglas Cross Country program has been very successful over the years. Team members are expected to put in long hours of training and be dedicated to the sport. This year the girl’s team has performed well in all its regular meets and invitational meets.

The Stoneman Douglas Cross Country program has been very successful over the years. Team members are expected to put in long hours of training and be dedicated to the sport. This year the girl’s team has performed well in all its regular meets and invitational meets.

In part of a statement she read during a recent Commission meeting, Gardner-Young said: “During my tenure, the City has accomplished so much. We built a new and rebuilt an existing fire station, stations 109 and 42, we completed the last 30 acres at Pine Trails Park, we built a new dog park, Barkland, we created the largest farmer’s market in Broward County, we moved the county line from Palm Beach County to Broward County bringing 1,900 acres into Broward and potentially all into the City, and we opened and took over operations of the City’s Community Center just to name a few. The residents feel the City is going in the right direction by the high scores we have received in our citizen surveys, the City is in great financial condition having survived the 2008-2009 recession without a loss in level of service and we are preparing financially for the future.”

In part of a statement she read during a recent Commission meeting, Gardner-Young said: “During my tenure, the City has accomplished so much. We built a new and rebuilt an existing fire station, stations 109 and 42, we completed the last 30 acres at Pine Trails Park, we built a new dog park, Barkland, we created the largest farmer’s market in Broward County, we moved the county line from Palm Beach County to Broward County bringing 1,900 acres into Broward and potentially all into the City, and we opened and took over operations of the City’s Community Center just to name a few. The residents feel the City is going in the right direction by the high scores we have received in our citizen surveys, the City is in great financial condition having survived the 2008-2009 recession without a loss in level of service and we are preparing financially for the future.”

who smoke may be at higher risk. Older people are also at greater risk.

who smoke may be at higher risk. Older people are also at greater risk.

ghost of a small boy roaming the premises. There have been strange sounds, and things moved in the mall.

ghost of a small boy roaming the premises. There have been strange sounds, and things moved in the mall. The museum is dedicated to the preservation of the history of the Packard Motor Car Company. There are 39 Packard cars on display, the oldest a 1909 model and the latest, a 1958 model. Most of the cars can still be driven. One can learn about each car on display and its unique features. You can see advertisements for the cars, and gain a sense of how the automobile industry developed.

The museum is dedicated to the preservation of the history of the Packard Motor Car Company. There are 39 Packard cars on display, the oldest a 1909 model and the latest, a 1958 model. Most of the cars can still be driven. One can learn about each car on display and its unique features. You can see advertisements for the cars, and gain a sense of how the automobile industry developed.